Advertisement

-

Published Date

March 11, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

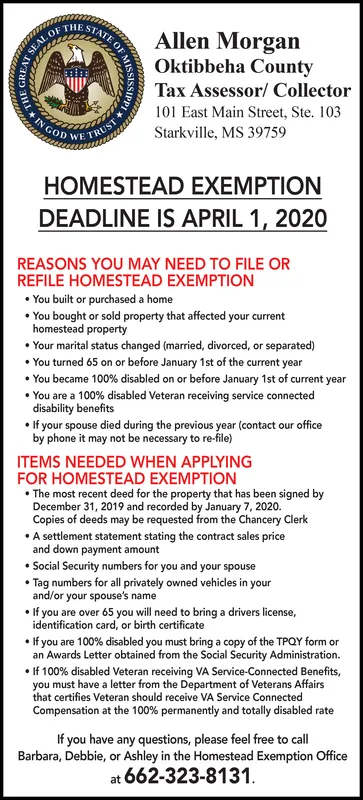

Allen Morgan ATE OF STA SEAL OF THE Oktibbeha County Tax Assessor/ Collector 101 East Main Street, Ste. 103 GOD Starkville, MS 39759 WE TRUS HOMESTEAD EXEMPTION DEADLINE IS APRIL 1, 2020 REASONS YOU MAY NEED TO FILE OR REFILE HOMESTEAD EXEMPTION You built or purchased a home You bought or sold property that affected your current homestead property Your marital status changed (married, divorced, or separated) You turned 65 on or before January 1st of the current year You became 100% disabled on or before January 1st of current year You are a 100% disabled Veteran receiving service connected disability benefits If your spouse died during the previous year (contact our office by phone it may not be necessary to re-file) ITEMS NEEDED WHEN APPLYING FOR HOMESTEAD EXEMPTION The most recent deed for the property that has been signed by December 31, 2019 and recorded by January 7, 2020. Copies of deeds may be requested from the Chancery Clerk A settlement statement stating the contract sales price and down payment amount Social Security numbers for you and your spouse Tag numbers for all privately owned vehicles in your and/or your spouse's name If you are over 65 you will need to bring a drivers license, identification card, or birth certificate If you are 100% disabled you must bring a copy of the TPQY form or an Awards Letter obtained from the Social Security Administration. If 100% disabled Veteran receiving VA Service-Connected Benefits, you must have a letter from the Department of Veterans Affairs that certifies Veteran should receive VA Service Connected Compensation at the 100% permanently and totally disabled rate If you have any questions, please feel free to call Barbara, Debbie, or Ashley in the Homestead Exemption Office at 662-323-8131. Allen Morgan ATE OF STA SEAL OF THE Oktibbeha County Tax Assessor/ Collector 101 East Main Street, Ste. 103 GOD Starkville, MS 39759 WE TRUS HOMESTEAD EXEMPTION DEADLINE IS APRIL 1, 2020 REASONS YOU MAY NEED TO FILE OR REFILE HOMESTEAD EXEMPTION You built or purchased a home You bought or sold property that affected your current homestead property Your marital status changed (married, divorced, or separated) You turned 65 on or before January 1st of the current year You became 100% disabled on or before January 1st of current year You are a 100% disabled Veteran receiving service connected disability benefits If your spouse died during the previous year (contact our office by phone it may not be necessary to re-file) ITEMS NEEDED WHEN APPLYING FOR HOMESTEAD EXEMPTION The most recent deed for the property that has been signed by December 31, 2019 and recorded by January 7, 2020. Copies of deeds may be requested from the Chancery Clerk A settlement statement stating the contract sales price and down payment amount Social Security numbers for you and your spouse Tag numbers for all privately owned vehicles in your and/or your spouse's name If you are over 65 you will need to bring a drivers license, identification card, or birth certificate If you are 100% disabled you must bring a copy of the TPQY form or an Awards Letter obtained from the Social Security Administration. If 100% disabled Veteran receiving VA Service-Connected Benefits, you must have a letter from the Department of Veterans Affairs that certifies Veteran should receive VA Service Connected Compensation at the 100% permanently and totally disabled rate If you have any questions, please feel free to call Barbara, Debbie, or Ashley in the Homestead Exemption Office at 662-323-8131.